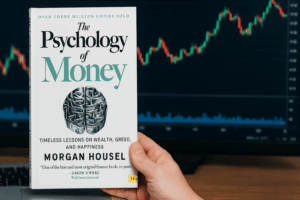

The Psychology of Money – a must-read for traders and investors.

There are books you read and forget, and there are books that permanently change how you see the world. The Psychology of Money by Morgan Housel belongs to the second category for me. It has profoundly shaped my view of trading, investing, and even life itself.

That’s why I felt I had to bring it up early in this blog. If you want a single piece of advice for the week: turn off Netflix and open this book. It will be worth it.

In the world of trading, most discussions revolve around charts, models, and algorithms. Yet, as Housel explains, the ultimate success factor is not technical sophistication but behavior. For those running automated systems through Interactive Brokers or using platforms like Email Trader, this insight is particularly relevant.

Here are three key takeaways from the book, directly applied to automated trading and portfolio management.

1. Discipline Beats Intelligence

“Doing well with money has little to do with how smart you are and a lot to do with how you behave.”

Even with automation, discipline is everything. I once designed a strategy on Interactive Brokers that looked perfect in backtests. But when volatility spiked, I manually interfered—pausing trades out of fear. Ironically, that decision turned a manageable drawdown into a real loss.

Email Trader helps reduce this bias by sticking to rules without hesitation. But the system is only as strong as the mindset of the person operating it. Smart code won’t save us from poor discipline.

2. Survival First, Optimization Second

“The most important part of every plan is to plan on the plan not going according to plan.”

Every trader dreams of maximizing returns. But the real priority is survival—ensuring the portfolio endures through unexpected events. A single margin call can wipe out years of compounding.

With Interactive Brokers, I learned the hard way that leverage amplifies not just returns but also risks. Email Trader enforces strict risk controls, but the lesson remains: your system must be built for resilience, not perfection.

3. Compounding Is Fragile but Powerful

“Compounding is not just the key to wealth; it’s the key to everything.”

The magic of trading is not in the brilliance of one big win, but in the quiet persistence of consistent gains reinvested over time. Yet compounding is fragile—one catastrophic error can destroy decades of growth.

Automation helps. By routing orders through Interactive Brokers via Email Trader, I can let strategies run day after day without emotional interference. But compounding only works if we protect the downside and stay in the game long enough to let time do its work.

Conclusion

The Psychology of Money is not a trading manual, but it offers something even more valuable: perspective. Interactive Brokers and Email Trader provide the tools to automate execution, but no software can replace mindset.

The three takeaways are simple but profound:

-

Discipline beats intelligence

-

Survival matters more than optimization

-

Compounding is fragile but powerful

Master these, and both your trading systems and your financial life will be built on solid ground.

A Personal Note

When I look back at my own journey—building automated strategies, chasing both gains and stability, starting automation with IBKR, or even building Email Trader—I realize that my biggest wins and biggest mistakes had little to do with coding or backtests. They had everything to do with my mindset.

Reading The Psychology of Money was a turning point. It reminded me that the real edge in trading and investing is not sharper indicators or more data, but the ability to think long term, protect capital, and let compounding work. In two words, I learnt enduring patience: the art of waiting without losing conviction.

If you take only one thing from this article, let it be this: before you upgrade your algorithm, upgrade your psychology.