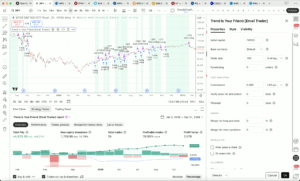

Backtest of the TrendIsYourFriend strategy on SPXL (2008–2025) using 120% of equity as order size. Results: +87,634% total return, 75% profitable trades, and a profit factor of 2.56.

In trading, some ideas sound almost too simple to be true. One of them is the momentum effect: assets that are going up tend to keep going up, and those going down often keep sliding. This effect has been studied for decades, and it’s powerful enough to inspire both academic papers and real-world trading strategies.

In this article, we’ll break down what momentum really is, why it works, how you can use it in portfolio management, and how it can be extended into automated trading systems. We’ll finish with a practical example: the TrendIsYourFriend Strategy on TradingView.

1. What Is Momentum?

Think of momentum in sports: when a team is on a winning streak, it often keeps winning because confidence builds and fans rally behind them. In markets, it’s similar. Assets that have performed strongly in the recent past often continue to perform well for a while.

Researchers noticed this effect decades ago. In the 1990s, two economists, Jegadeesh and Titman, showed that stocks that were “winners” over the past year often stayed winners in the following months. The same was true for “losers.” This became known as the momentum anomaly, because it doesn’t fit perfectly with the idea of perfectly efficient markets.

In simple words: momentum means trends often last longer than you expect.

2. Why Does Momentum Work?

If markets were perfectly efficient, momentum shouldn’t exist—prices would instantly reflect all information. But in reality, people and markets behave in ways that create trends. Here are some reasons why:

-

Slow reactions: Investors don’t always react instantly to news. Prices adjust step by step.

-

Herd behavior: When some traders jump on a rising stock, others follow, reinforcing the trend.

-

Overconfidence: People tend to believe “the trend is your friend” and push it further.

-

Practical limits: Even professional investors can’t always trade fast enough to remove these patterns—there are costs, risks, and rules that slow them down.

Of course, momentum doesn’t work all the time. In market crashes or sudden reversals, momentum strategies can suffer. They shine best in markets that have clear, lasting trends.

👉 For a deeper dive, see Why Momentum Investing Works – UCLA Anderson Review.

3. How to Use Momentum in Portfolio Management

Momentum is not just an idea; it can be turned into rules you can follow systematically. Here’s how.

3.1 Picking Time Windows

Momentum strategies usually need two choices:

-

Lookback period (how far back you check): for example, check the performance over the last 6 or 12 months.

-

Holding period (how long you keep the asset): for example, stay invested for 3 or 6 months.

So if we say “12/3 momentum,” it means:

-

Look at the past 12 months of returns.

-

Pick the winners.

-

Hold them for 3 months.

Some people skip the very last month of data because very short-term moves often bounce back.

👉 Rule of thumb: Shorter holding = more trades, faster reactions. Longer holding = fewer trades, lower costs, but slower to catch new moves.

3.2 Choosing What to Trade

You can apply momentum almost anywhere:

-

Individual stocks

-

ETFs (for sectors like tech or value stocks)

-

Commodities (gold, oil, etc.)

-

Cryptocurrencies

-

Entire portfolios (like the S&P 500 vs. small-cap indexes)

In fact, some indices themselves are built with momentum baked in.

-

The S&P 500 (SPY), for example, naturally gives more weight to stocks that have risen in price because it is market-cap weighted.

-

The Nasdaq-100 (QQQ) has also benefited historically from momentum, as it concentrates on high-growth, high-performing tech stocks.

So when you invest in these indices, you are indirectly harnessing momentum—though in a broad and passive way. Momentum strategies take this further by explicitly ranking and rotating between the best-performing assets.

👉 Curious about quantitative implementations? Check Quantpedia’s overview of the momentum factor.

3.3 Managing Risks

Momentum strategies can be powerful, but they’re not invincible. To protect yourself:

-

Diversify: don’t put everything in one stock. Spread across several assets.

-

Rebalance regularly: update your list of “winners” (monthly is common).

-

Stay aware of market regimes: momentum can get hurt in sideways or crashing markets.

4. From Portfolio Momentum to Automated Trading: The TrendIsYourFriend Extension

4.1 Building the momentum portfolio

Building a portfolio around momentum, and re-arranging it once in a while, is a solid first step: you select the strongest assets based on past performance, allocate capital, and let trends carry you forward. But momentum doesn’t have to stop at the portfolio level—it can also be applied inside each asset on a smaller timeframe to improve returns.

This is where strategies like TrendIsYourFriend come in.

👉 TrendIsYourFriend Strategy on TradingView

Here’s the idea:

-

Step 1: Construct a normal momentum portfolio as explained above by choosing 6–8 assets among these ones: SPY, IWM, VYM, XLK, SPXL, BTC, GOLD, VT, PG, CQQQ, EWC, EWJ

-

Step 2: Instead of simply holding these assets passively, you apply a short-term momentum system—TrendIsYourFriend—that actively trades each position. The strategy enters LONG when a short-term upside trend is confirmed, or when temporary pullbacks occur inside a larger upside trend (“buy the dip” opportunities). Security exits are managed through a dynamic stop-loss, itself calculated from continuous trend calculations, which adapts as the market evolves.

4.2 The double-layer approach in practice

-

At the portfolio level, you capture medium-term momentum by selecting the right assets.

-

With TrendIsYourFriend, you refine those holdings through shorter-term trades, designed to capture extra returns while keeping risk under control for boosting your alpha, and just with a rough 55%–65% time-in-market.

The result is a momentum approach working on two complementary layers: investing to ride long-lasting trends, and trading to extract more value from short-term moves.

4.3 Resilience during market downturns

It’s important to note that TrendIsYourFriend does not shield you entirely from market crashes or even normal corrections. However, it does soften their impact. By reducing exposure during downturns, the strategy helps you preserve more capital. Once the market recovers, you re-enter with a stronger purchasing power in terms of assets compared to what you would have had with a simple buy & hold. This effect is visible when zooming into past downturns—whether in the 2008 financial crisis, the Covid crash in 2020, or the recent correction of February 2025.

Backtest on SPY during the 2008 crash (initial capital $10,000, order size 100% of equity). Despite the market turmoil, the strategy achieved +48.21% return with a profit factor of 3.57 and 78.95% profitable trades.

Conclusion

Momentum is one of the simplest yet most reliable effects in markets. It tells us that trends don’t just appear out of nowhere and that they often keep going. By building portfolios around this effect, and by extending it into shorter-term automated trading systems like TrendIsYourFriend, you can bridge the gap between investing and trading.

This hybrid approach shows that investing and trading are not opposites—they can work together. A well-constructed momentum portfolio provides the foundation, while a trend-detection strategy optimizes each position in real time.

And here’s a key differentiator: with TrendIsYourFriend, you don’t even need to be in the market 100% of the time. In fact, with just 55%–65% time-in-market, the strategy can still capture strong returns while reducing exposure during less favorable periods.

👉 Ready to see it in action?

Test the strategy directly on TradingView, play with the parameters, plug it into Email Trader, and boost its performance to fit your momentum portfolio:

Try TrendIsYourFriend Strategy Here

In future articles, we’ll dive deeper into how investment structures and trading overlays can be combined to create resilient, profitable strategies.